|

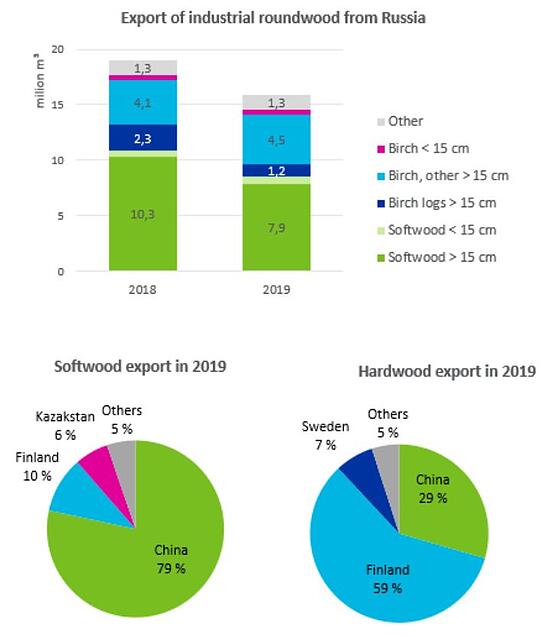

Russia’s Proposed Roundwood Export Ban Would Impact Global TradeBy Agris Melnis, Regional Sales Manager, Baltic Rim, Forest2Market March 23, 2021 - Last fall, Russian president Vladimir Putin introduced legislation that would initiate a complete ban on exports of softwood and high-value hardwood logs from the country beginning January 1, 2022. Once established, this could also expand to include untreated or roughly processed green wood/lumber. This reduction in roundwood exports is intended to stimulate additional economic activity within Russia and help to mitigate illegal logging. On January 1, 2021, an experiment on the traceability of timber turnover was launched, and will run through June 30, even though the ban is expected to be adopted as law in 2Q2021. The global market for unprocessed timber will face significant shocks in the wake of such legislation resulting in a ban on Russian exports. By the end of 2020, Russia exported nearly 16 million cubic meters (m3) of timber, which represents almost 13% of globally traded roundwood. China, which is the largest purchaser of logs from the far eastern region of Russia, will likely bear the brunt of this coming change. As a result, China will likely begin seeking out new suppliers in other regions such as Australasia, parts of Europe and the US. In the longer term, China is expected to shift a significant portion of its import volume from roundwood to sawn lumber. Russia’s Forest ResourcesRussia contains the largest area of natural forests in the world, covering 49% of the country’s landmass and 815 million hectares (2 billion acres), which is roughly 23% of the planet’s total forested area. Yet, much of the country’s forests are under threats of rapid deforestation. From 2001 to 2019, Russia lost approximately 65 million hectares (161 million acres) of relative tree cover, equivalent to an 8.5% decrease since 2000 and 18% of the global total. In 2018, Russia lost 5.6 million hectares (14 million acres) of tree cover. This rapid loss of forest resources could be impacting Russia’s desire to seek trade and policy solutions to help mitigate further deforestation. According to statistics from the Russian Forestry Agency, wood harvesting in 2019 totaled 219 million m3, and export volumes were approximately 18 million m3.

Russia is no stranger to using policy as a means to control its wood resources. In 2018, the government introduced export quotas for birch plywood logs for the first half of 2019. As a result, the total amount of exported birch logs in 2019 amounted to roughly 1.3 million m3, while just a year earlier this figure was approximately 1.9 million m3. As a result, in 2019, plywood production in Russia increased compared to 2018 as the wood raw materials stayed in-country and were used to expand manufacturing capacity. This legislative tactic has demonstrated effectiveness in the case of birch logs — but can such results be replicated for all Russian roundwood? A ban on the export of all roundwood carries some additional challenges, including the risk of bankruptcy and the shuttering of small and medium-sized businesses focused only on this activity, which can also lead to a decrease in efficiencies throughout the industry, and an increase in tensions among forest industry stakeholders. To avoid such a predicament, the government is planning to launch a special modernization program through the Industrial Development Fund for small- and medium-sized businesses currently working in this space. This would help create loans for new equipment needed to help modernize and upfit existing facilities, as well as the establishment of new wood processing facilities. The export ban will also affect other supply chain stakeholders related to roundwood production, including the transportation industry — particularly the railway sector — which is widely used for roundwood transportation. A ban on Russian roundwood exports will certainly increase investment in the country’s wood processing sector and as a result, many local entrepreneurs are looking for new opportunities in Russia’s forest sector. However, such a ban could also carry the unintended consequence of damaging trade relations with some of its largest trading partners — most notably, China. About the AuthorAgris Melnis is Forest2Market’s Regional Sales Manager for European markets, including the Nordics, the Baltic States and Russia. In this role, Melnis serves as a supply chain expert and advisor to existing and prospective customers in the region and advises participants in the forest products industry on the use and integration of Forest2Market products and services into their business decisions. Agris has more than 20 years of experience in all phases of the wood fiber supply chain, from forest operations and procurement to product certification and export logistics. SOURCE: Forest2Market |