|

Global Shipping Companies End Recovered Paper Exports to China

By Tim Woods Managing Director of IndustryEdge (for Forest2Market's blog)

July 20, 2020 - Recovered paper shipments to China could cease before the end of 2020, with global shipping companies now rejecting shipments for delivery after the end of September. The second and fifth largest global shipping conglomerates (Mediterranean Shipping Company [MSC] and Hapag Lloyd) have announced separately that they will cease shipping recovered paper to China before the end of 2020.

The move by the shipping lines is in response to Chinese laws that were introduced in late April that move China much closer to its stated aim of ending recovered paper imports entirely by the end of 2020.

Key Points:

- Chinese officials have repeatedly signaled an end to imports of recovered paper

- In April, China tightened its solid waste management laws

- In late June, the Chinese Government announced it would ban the importation of solid waste from 2021

- Major shipping lines are getting ahead of any bans, reducing their potential liabilities

It appears that both companies plan to cease taking containers that would be delivered to China after the beginning of October, as part of a risk management strategy. IndustryEdge was recently advised by a client that other shipping companies are also conducting “consultations” on the future of recovered material shipping to China.

In the interim, China’s import permits continue to be metered out on a national needs basis, leaving exporters from countries like Australia and New Zealand uncertain about even short-term shipments.

Month-on-month permits are extremely volatile and expected to result in China’s total recovered paper imports declining to less than 5 million tons in 2020, down from a peak of around 28 million tons in 2017.

This development must be viewed alongside the other significant development in global fiber markets of the last two years: the rapid expansion in the number of mills producing recovered paper pulp for shipment to China. Mills have been converted and established in North America, Malaysia and Vietnam, most significantly.

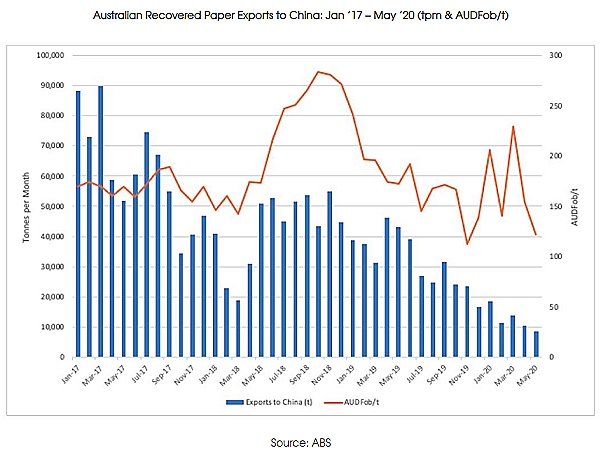

The likelihood is that by year’s end, Australian suppliers will be seeking alternative markets to China in larger proportions than ever before. Over the year-ended May 2020, Australian recovered paper exports to China totaled 249.2 kt (valued at AUDM41.2), down 54 percent on the prior year. In fact, at just 8,579 tons in May 2020, Australia’s exports of recovered paper to China were their lowest in more than seven years, with average prices at AUDFob122/t, within range of the lowest monthly average price ever recorded.

Indonesia is the next most likely destination for Australia’s recovered fiber. Over the year-ended May 2020, Indonesia received 295.5 kt of Australian recovered paper (valued at AUDM52.8). However, Indonesia’s market is already close to capacity and is expected to be swamped with potential supply options, placing obvious pressure on prices. Indonesia has recently repositioned its recovered paper import quality requirements, and countries like Korea are in the process of doing the same.

One possibility under active consideration in some parts of the recovered paper sector is whether exports could be allowed into countries making recovered paper pulp that will ultimately be sent to China. That consideration alone is an indication that recovered paper pulping, for the international market, needs to be on the Australian infrastructure investment table right now.

About IndustryEdge

IndustryEdge is Australia and New Zealand’s dedicated provider of market intelligence, trade data and analysis in the paper, paper products, pulp and recovered paper sectors. For further information, visit: industryedge.com.au

Forest2Market provides pricing data, supply chain expertise and strategic consulting services to participants in the global wood and fiber supply chain. The Forest2Market's unique databases contain more than 400 million rows of transaction data; they are the foundation for all analytics available in the firm's business intelligence platform, SilvaStat360, as well as client resource studies and consulting engagements. To learn more, visit www.forest2market.com.

SOURCE: Forest2Market |