|

LD Celulose Ramping-Up Production at New Dissolving Pulp Mill in Brazil

April 25, 2022 - LD Celulose S.A, a joint venture between the Austrian company Lenzing and the Brazilian company Dexco, invested about USD 1.3 billion in a 500,000 tonne/year dissolving wood pulp mill in the Triângulo Mineiro region in Brazil. Valmet delivered the key process islands and integrated automation solutions for the mill. The equipment operations and the production ramp-up in the new mill have now successfully started.

Valmet delivered the project with extended scope of supply. Detailed engineering for the project was started in the beginning of 2020 and the installation works at the site in the beginning of 2021.

"Our new mill brings a positive socioeconomic impact throughout the region," said Luís Künzel, CEO of LD Celulose. "The dissolving pulp is a key raw material for manufacturing Lenzing's wood-based textile and specialty fibers.

"This mill is among the most productive and energy-efficient mills in the world. We have adopted the most advanced technologies in the mill, not only in the sustainable production process, but also in the solutions that seek to reduce emissions to the environment. We are very happy that despite the outside challenges we have been able to follow our schedule," Künzel explained.

Bertel Karlstedt, Business Line President, Pulp and Energy for Valmet, commented, "This project is an excellent reference of dissolving pulp technology and our green field pulp mill delivery capability. Almost everything in this project was implemented during the global Covid-19 pandemic. We have been working remotely in engineering, project management and even in factory acceptance test for the automation system. This has required a lot of trust and communications between the Valmet and LD Celulose teams and special attention to planning and scheduling. I'm pleased to see how our teams have reached this important milestone of starting the production at the site."

Valmet's complete delivery included a fiber line, a pulp drying and baling line, an evaporation plant, ash crystallization, a white liquor plant, mill-wide automation system, analyzers and operator training simulators for all process areas.

Valmet noted that its Operator Training Simulator (OTS) will be used in all process islands, from the beginning to the end of production, with a total of 14 process areas. An innovative fact of the project is that its wood handling area is the first in Brazil to use OTS technology. Another highlight is the presence of simulators for the areas of water treatment, water treatment for boilers, effluent treatment and turbines, commonly little explored in the OTS.

Valmet is a leading global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries. The company's technology offering includes pulp mills, tissue, board and paper production lines, as well as power plants for bioenergy production.

SOURCE: Valmet |

|

|

Stora Enso Divesting Its Sawmills and Forest Operations in Russia

April 25, 2022 - Stora Enso has entered into an agreement to divest its two sawmills in Russia. The company’s Nebolchi and Impilahti sawmills will be divested to local management.

In addition, the divestment includes Stora Enso’s Russian forest operation which through its harvesting supplies wood to the sawmills.

Stora Enso’s assessment is that due to the uncertainties in the Russian market, local ownership and operation can provide a more sustainable long-term solution for these business operations and the employees working there.

The transaction is, pending necessary approvals, expected to be concluded within Q2 2022 and will have no material impact on Stora Enso’s annual sales and Operational EBIT. Due to decreased business prospects on these businesses, an impairment loss of EUR 70 million has been recorded in the first quarter result. The additional loss on the transaction under IFRS will be approximately EUR 60 million, consisting mainly of currency translation adjustments to be recorded at the closing date. The expenses are considered as items affecting comparability.

The sawmill sites are located in Novgorod and Karelia employing approximately 330 people and have a total annual capacity of 350,000 m3 of sawn timber, including 55,000 m3 of processed timber and 65,000 tonnes of pellets.

Stora Enso’s Russian forest operations employs approximately 170 people and manages long-term harvesting rights for around 370,000 hectares.

Stora Enso announced on 2 March 2022 that it would stop all production and sales in Russia until further notice. The Group is in a process to find a sustainable solution for the future of its three packaging plants in Russia.

SOURCE: Stora Enso |

|

Weyerhaeuser to Acquire 80,800 Acres of Timberlands in North and South Carolina

April 19, 2022 - Weyerhaeuser Company on April 14 announced an agreement to purchase 80,800 acres of high-quality timberlands in North and South Carolina from a fund managed by Campbell Global for approximately $265 million. The acquisition is comprised of highly productive timberlands situated in strong coastal markets and strategically located to deliver immediate synergies with existing Weyerhaeuser timber and mill operations.

Additionally, the acquisition is expected to deliver portfolio-leading cash flow and harvest tons per acre within the company's Southern Timberlands business.

Key attributes include:

- Fee ownership with 89 percent planted pine acreage and strong site productivity delivering attractive long-term timber returns

- Well-stocked timber inventory with a mature age class producing attractive sawlog mix and average harvest of 6.5 tons per acre (or 520,000 tons) annually over the first 10 years

- Expected average Adjusted EBITDA of approximately $160 per acre (or $13 million) annually from timber operations over the first 10 years

- Significant optionality to capture additional upside from real estate and natural climate solutions opportunities

"This transaction is a great example of our ongoing efforts to enhance our portfolio with high-quality, well-managed timberlands that generate solid returns for our shareholders," said Devin Stockfish, president and chief executive officer. "These Carolina timberlands are strategically located, well-integrated with our existing operations and offer very attractive timberland attributes, and they will provide strong cash flows for our Southern Timberlands business."

With this acquisition, Weyerhaeuser will own or manage more than 900,000 acres of timberlands in the Carolinas, and the company also operates four mills, a distribution center and tree nursery and hosts multiple mitigation banks and real estate development projects — employing more than 700 people between the two states.

The transaction is subject to customary closing conditions and is expected to close in the second quarter of 2022.

Weyerhaeuser Company (NYSE: WY), one of the world's largest private owners of timberlands, began operations in 1900. The company owns or controls approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada.

SOURCE: Weyerhaeuser Company |

|

Sanctions against Russian Exports will Permanently Alter the Global Trade of Forest Products

April 14, 2022 - Lumber trade flows changed almost instantly when Russia invaded Ukraine in late February. Trade sanctions and restrictions in financial transactions by Europe, North America, and major markets in Asia halted shipments from Russia and Belarus. In addition, exports from Ukraine were also disrupted. The total lumber exports from the three countries in the war zone were 34 million m3 in 2021. Over 25% of that volume was exported to countries with current sanctions against Russia and Belarus.

In addition, the two major wood certification organizations, FSC and PEFC, have labeled all timber from the two countries as "conflict timber." The removal of the labeling means that the timber cannot be used in certified products, which will impact any country buying wood from Russia and Belarus and manufacturing certified products, e.g., lumber, plywood, pulp, and paper for sales worldwide.

The total volume of softwood lumber that is now unlikely to reach the market in Europe and Asia (outside China) because of sanctions is an estimated 10 million m3, or just over 30% of the total export volume shipped from Belarus, Russia, and Ukraine in 2021, reports the Wood Resource Quarterly. In addition, lumber sold to customers in China that require certified wood for manufacturing forest products targeting Europe and North America will no longer be available from Russia. Europe, which imported 8.5 million m3 of softwood lumber from the three countries in 2021, will be the hardest hit, as the lumber import volume accounted for close to 10 percent of the total consumption on the continent in 2021.

Although the Chinese government has not set up any barriers to trade between them and Russia, it is still conceivable that there will be interruptions in shipments between the two neighbors. Some of the factors that may reduce trade even with countries that have no sanctions with Russia and Belarus include:

- Foreign investors in the Russian forest industry may withdraw their presence and financial funding, making it more challenging to produce and export to any market.

- A weak Russian Rouble (down over 20% in three weeks since the war started) will make importing equipment and spare parts for logging companies and forest product manufacturers very costly.

- The removal of Russian banks from the international payment transaction system SWIFT will complicate payments for exported Russian products and imports of most equipment for the forest industry, from timber harvesters and forwarders to machinery for sawmills, plywood mills, and pulp mills.

- Russian manufacturers of pulp, paper, plywood, and lumber can no longer offer PEFC or FSC certified products.

Global trade flows of forest products have already changed significantly and will continue to change due to the Russian invasion of Ukraine. Even when peace is ultimately reached, it is improbable that trade will revert to pre-war patterns.

Wood Resource Quarterly, published by Wood Resources International, is a 75-page report established in 1988 and has subscribers in over 30 countries. The publication tracks prices for sawlog, pulpwood, lumber, and pellets and reports on trade and wood market developments in most key regions worldwide. For further information, visit: www.woodprices.com.

SOURCE: Wood Resources International LLC |

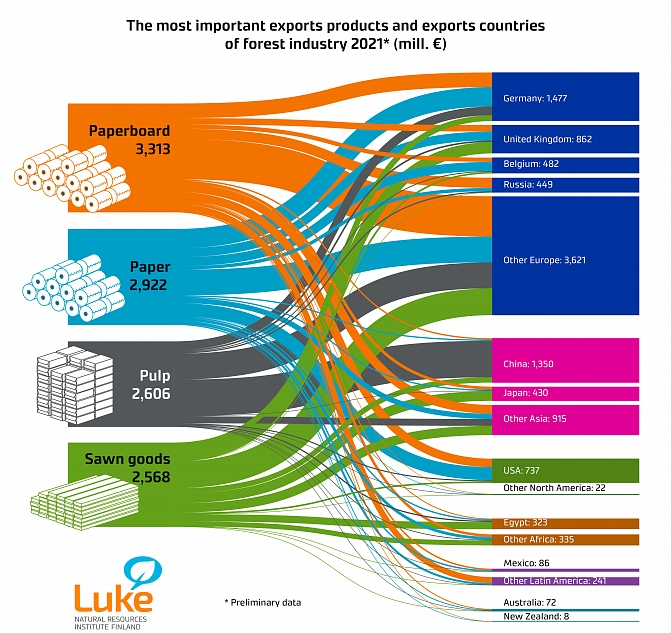

Finland's Exports of Paperboard Grew to EUR 3.3 Billion in 2021

April 12, 2022 - According to preliminary data for 2021 published by the Natural Resources Institute Finland (Luke), the export value of forest industry products was a little more than EUR 13 billion. As a result of the global rising demand and prices for sawn goods, the export value of the wood-products industries accounted for as much as 29 per cent of forest industry exports. Imports of roundwood and wood residues into Finland totalled 13 million cubic metres, slightly more than half of which consisted of pulpwood.

The export value of forest industry products increased by 16% from the previous year in real terms to EUR 13.1 billion. Compared with the previous ten-year average, exports were, however, only 2% higher (deflated using the wholesale price index). In the wood-products industries, exports increased by 42% from the previous year to EUR 3.9 billion, while in the pulp and paper industries exports increased by 8% year-on-year to EUR 9.3 billion. The forest industries accounted for 19% of Finland's total goods exports in 2021.

High Demand for Sawn Goods

A total of 8.7 million cubic metres of sawn goods were exported, with an export value of EUR 2.6 billion.

"Sawn goods had the highest export value out of all products in the wood-products industries, accounting for a fifth of the total export value of the forest industries. The export value of sawn goods increased by a whopping 51% from the previous year and as much as 49% compared to the previous ten-year average. The export volume increased more modestly: by 6% from the previous year and by a tenth from the previous ten-year average," says Eeva Vaahtera, senior statistician at Luke.

Paperboard passed paper as the most important export product, covering a quarter of the total export value of the forest industries, while paper remained at 22%. The export value of paperboard increased by a tenth from the previous year to EUR 3.3 billion, whereas that of paper decreased by 4% to EUR 2.9 billion.

Magazine paper was the most exported paper grade, with its export value increasing by 4% from the previous year to EUR 1.2 billion.

The most exported paperboard group consisted of multi-ply paperboard coated with kaolin and paperboard coated with plastic (Other coated paperboard in Luke's statistics), covering 59% (EUR 2.0 billion) of paperboard exports (up by 3% from the previous year). Compared to the previous ten-year average, the export value of paper has decreased by 40%, while that of paperboard has increased by 23%.

The Export Price of Pulp Increased

Pulp exports totalled 4.6 million tonnes, with an export value of EUR 2.6 billion, accounting for a fifth of the export earnings of the forest industries. The export value of pulp increased by 27%, driven by rising prices, even though the export volume only increased by 4%. Of the total value of pulp exports, bleached sulphate pulp accounted for 82%, and its export value increased by a little more than a fifth, while its export volume decreased by 1%.

"The most important export countries for the forest industries were Germany, China and the UK. Germany accounted for 13% of the export earnings of the forest industries, while China made up 10% and the UK 8%," Vaahtera says.

In 2021, Finland's exports of roundwood and wood residues totalled 1.4 million cubic metres, of which pulpwood accounted for 59%, logs 23% and wood chips a tenth. Sweden represented 82% of all exported wood, Egypt 6% and the UK 3%.

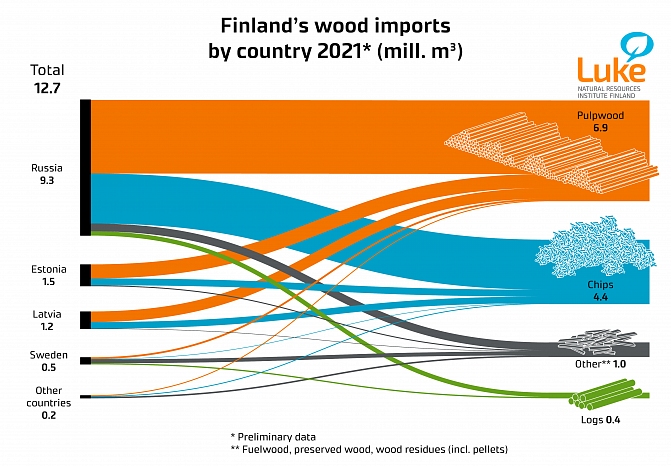

The Volume of Wood Imports Remained at 13 Million Cubic Metres

In 2021, Finland's wood imports totalled 12.7 million cubic metres, or EUR 0.5 billion. The volume of wood imports remained unchanged from the previous year. Of wood imports, pulpwood accounted for a little more than a half and chips 35%. Fuelwood, preserved wood and wood residues combined made up 8% and logs 3%. The import volume of pulpwood increased by 2% from the previous year, while that of wood chips remained at the same level. Log imports decreased by a fifth.

The highest volume of wood was imported from Russia, accounting for 73% of all wood imports. It was followed by Estonia with 12% and Latvia with 9%.

The import value of forest industry products was EUR 1.5 billion, up by 2% in real terms from the previous year. Wooden furniture accounted for a fifth, converted paper and paperboard products 18 % and paperboard 12% of the import value. Sweden, Estonia and Russia were the most significant import countries.

The Natural Resources Institute Finland (Luke) is a research organisation operating under the Ministry of Agriculture and Forestry of Finland. Luke's task is to promote competitive business based on the sustainable use of renewable natural resources, as well as wellbeing and the vitality of the countryside. To learn more, visit: www.luke.fi.

SOURCE: The Natural Resources Institute Finland (Luke) |

|

|