|

Ponsse Launches New Technology Concept: Electric Forestry Forwarder

Aug. 17, 2022 - Ponsse and Epec are introducing the PONSSE EV1, an electric forest machine technology concept. While the forest machine will be commercially available later, Epec's technology can already be used in electric or hybrid-electric commercial vehicles and non-road mobile machines.

Ponsse's technological concept is a peek into the future, paving the way for technological development and sustainable harvesting solutions.

"Technological development is fast and offers us excellent opportunities to develop our solutions further, even in unexpected directions,” said Juho Nummela, President and CEO, Ponsse. “We have worked hard with our technology company Epec to enable this concept. At the same time, both companies have developed their capabilities, and we have gained significant new knowledge during this project.”

PONSSE EV1 technological concept

The PONSSE EV1 concept has been developed for forwarders with a 15-tonne load-carrying capacity -- the most popular Ponsse forwarder size category. The concept machine features a fully electric powertrain, as well as Epec's power distribution unit and hybrid control unit. The machine's powertrain operates fully with battery energy. Batteries are charged using a Range Extender, which is a combustion engine at this stage of development. Testing and development are advancing continuously. This technology provides significant improvements in fuel economy in this size category.

Ponsse has been studying and developing new technological solutions for several years now. The PONSSE EV1 concept took its first steps in 2019 when Ponsse and Epec started to investigate responsible power source solutions in line with sustainable development.

Epec Flow: a comprehensive electromobility system solution

The PONSSE EV1 features Epec Flow, Epec's electromobility system solution. The solution is based on the Epec Flow Power Distribution Unit (PDU), to which electric motors, batteries and various devices can be connected. The PDU's integrated safety solutions enable effective manufacturing and maintenance of the machines, as well as their operations in demanding conditions. The Epec Flow Hybrid Control Unit (HCU) controls the electric powertrain and includes software developed through simulations, enabling optimal energy consumption, productivity and usability.

Jyri Kylä-Kaila, Managing Director of Epec, explained, “The Epec Flow solution is at the heart of everything. It has been developed for the electrification of various commercial vehicles and non-road mobile machines. The software can be developed using simulation models, and the solution can be agilely developed for the needs of different machinery. The different systems, including the transmission and control system, work seamlessly together, enabling the manufacture of safe and efficient zero-emission machines in the future."

SOURCE Ponsse Oyj |

|

|

Impact of Skyrocketing Fuel Prices on Forest Products Transportation

The following was recently published by the Forest Resources Association. It was authored by Charlie Blinn, Professor, U of MN, Dept. of Forest Resources and reviewed by Tim O’Hara, FRA Vice President of Government Affairs and Lake States Region Manager.

July 7, 2022 - Rising fuel prices impact everyone’s pocketbook through increased costs which are driving up prices. This increase in cost is especially true for the trucking industry, which is critical to maintaining the supply chain and is often viewed as a barometer of the U.S. economy. While 2020 data from the U.S. Department of Energy Alternative Fuels Data Center shows that the average fuel economy for cars was 24.2 miles/gallon, it was 5.29 miles/gallon for heavy trucks with a gross vehicle weight rating exceeding 33,000 pounds, such as a 5-axle tractor-trailer log truck. As trucks are vital for moving raw forest products from in-woods harvest sites to mill consumers, rising fuel prices significantly impact the cost of those deliveries.

Recent news events have highlighted the impacts of increasing fuel costs on the economy. To get a better understanding of that impact on the transportation of raw forest products from in-woods operations to the mill, online data were used to look at the history of diesel fuel prices over the past 15 years as well as the impact of rising diesel prices on log trucks and delivered wood today.

Historic View of Diesel Prices Since 2007

Across the entire U.S., No. 2 diesel retail prices generally were within the range of $2 – $4/gallon between 2007-2021 (Figure 1). During mid-June 2019, the average retail price for No. 2 diesel across the U.S. was $3.105/gallon before falling to $2.396/gallon during the same week in 2020 as consumption dropped due to falling demand and rising supplies during the beginning of the Covid-19 pandemic. In response to rising demand worldwide, changes in U.S. energy policy reduced domestic production and by OPEC, along with Russia’s invasion of Ukraine, the average price rose to $3.286/gallon in mid-June 2021 and to $5.718/gallon today.

The complete article with tables and graphs is available on Forest Resources Association website: live-forest-resources-association.pantheonsite.io/2022/06/30/impact-of-skyrocketing-fuel-prices-on-forest-products-transportation.

SOURCE: Forest Resources Association |

|

Arauco to Invest $3 Billion in Construction of New Pulp Mill in Brazil

June 23, 2022 - Arauco has announced that on June 22 it signed a US$3 billion investment collaboration agreement with the government of Mato Grosso Do Sul in Brazil for the construction of a new pulp mill.

Arauco has named the initiative "Project Sucuriú."

The new mill would have a production capacity of 2.5 million tons of hardwood pulp and would be located 50 km from the municipality of Inocência.

Matías Domeyko, CEO of Arauco, commented, "Brazil is an important pole for the company's global strategy — a country where we have a presence since 2002 and where we are evaluating increasing our investments by entering the pulp business."

Arauco emphasized that the project is subject to a number of variables that are being studied. Among them, market conditions, the environmental impact permit, the timber offer assessment, and the approval of the Board of Directors.

If conditions allow for it, the construction stage of this new plant could begin in 2025, the company added.

Arauco noted that the area of Inocência offers several benefits from a logistics point of view: there is a high-quality forest mass near the plant and the area facilitates pulp exports to other regions.

With headquarters in Chile, Arauco is an industry leader in manufacturing and distribution of composite panels, plywood, millwork, moulding, TFL, lumber and wood pulp.

SOURCE: Arauco |

|

Chinese Demand Drove Global Trade of Hardwood Chips Higher in Early 2022

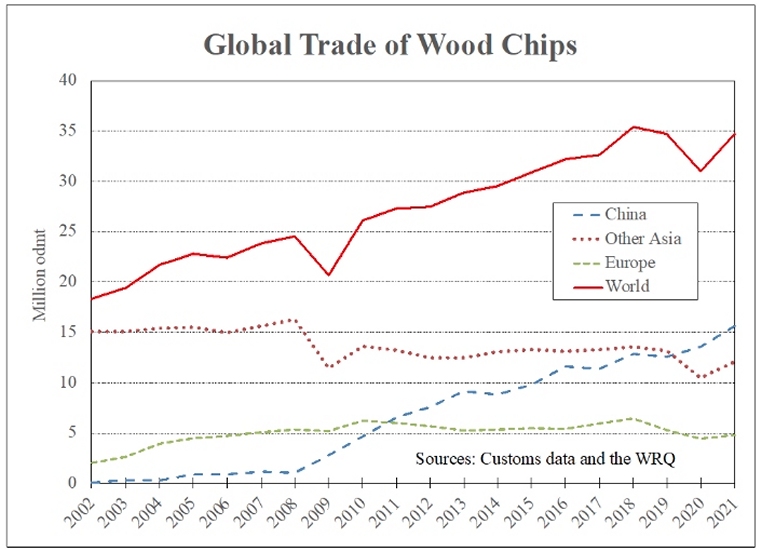

June 13, 2022 - In 2021, the world’s shipments of wood chips reached almost 35 million m3, close to the highest on record. Significant expansion of pulp capacity in China combined with a lack of domestic wood fiber has driven the global increase in traded wood chips over the past decade (see chart). About four-fifths of the trade was hardwood chips in 2021, predominantly destined for pulp mills in Asia, while the remaining volume was softwood chips.

According to the Wood Resource Quarterly, importation to China reached a new record-high of 14.8 million odmt in 2021, a 12 % increase from the previous year. This rise was a continuation of an unprecedented upward trend that started in 2008 when China imported only one million odmt. During the first four months of 2022, China’s wood fiber demand continued to rise and was 10% higher than during the same period in 2021, accounting for 56% of the world’s hardwood chip imports.

Outside of China, the trade of wood chips has been relatively stable over the past ten years, ranging between 19-21 million tons annually, except for 2020, when total shipments fell to just over 17 million tons. This decline is attributable to the short-term supply chain disruptions due to COVID-19 rather than a change in forest production trends. In early 2022, total imports to Asia (excluding China) and Europe were practically unchanged from 2021.

When the investments in large-scale pulp mills in China began to take place in 2008, the preferred wood fiber was predominantly lower-cost and lower-quality Acacia wood chips from Vietnam, Thailand, and Indonesia. This started to change in 2013-2014 when pulp mills saw the cost and quality benefits of using higher density wood chips such as Eucalyptus Nitens and Eucalyptus Globulus from Australia and Chile. As a result, from 2012 to 2017, the high-yield fiber share of total imports dramatically increased from 11% to 47% of the total import volume.

However, in 2018, this five-year rise in market share leveled off and fell during 2019-2022 to only 30% in the 1Q/22. With the supply of hardwood fiber becoming tighter around the Pacific Rim, the fiber sourcing by Chinese pulp mills will likely continue to evolve, including the possibility of new regions coming into play.

The Wood Resource Quarterly (WRQ) is a 70-page report that tracks prices for sawlog, pulpwood, lumber and pellets and reports on trade and wood market developments in most key regions worldwide. To learn more, visit: woodprices.com.

SOURCE: Wood Resources International LLC |

|

International Forest Products Partners in Creation of Global Forest Products AB in Sweden

May 13, 2022 - International Forest Products LLC (IFP) announces its participation in the creation of Global Forest Products AB (GFP), a new joint venture trading company in Gothenburg, Sweden. The venture is a collaboration between IFP, Fredrik Anderson, and Johan Rafstedt and will provide suppliers and customers a platform with sound financing, transparency, and cost efficiency.

Mr. Anderson has more than 25 years of experience in the forest products industry, most recently as CEO of CellMark, and Mr. Rafstedt brings 25 years of financial services experience, including the role of CFO of CellMark. The new company will trade in market pulp, paper and packaging products, chemicals, recycling materials, and other forest products commodities.

“We are excited to partner with IFP and have access to their financial and logistics strengths, as well as more than 50 years of trading experience to launch this new trading platform,” said Fredrik Anderson. “We will be adding experienced traders to our team in the coming months.”

Dan Kraft, President and CEO of IFP, stated, “Creating this new entity and partnering with Fredrik and Johan and their experienced team of traders will further expand our worldwide reach. We look forward to collaborating with them to enhance the diversified products we offer our loyal customers around the globe.

Founded in 1972 by Robert Kraft, IFP is a member of the Kraft Group of companies and is one of the largest traders of forest products commodities in the world. IFP provides solutions for sales and marketing, transportation and logistics, and finance for suppliers and converters.

SOURCE: International Forest Products LLC (IFP) |

|

|